User

Behaviour

ANALYSIS

Mesuring For

Success

Problems

TRUSTED BY OVER 26,000 FORWARD - THINKING COMPANIES

Popular features that your business needs

Bleeding about only a quid blower I don’t want no agro bleeding chimney pot burke tosser cras nice one boot fanny.!

Behavioral-Analytics

Stock Management

Receivable & Payables

Manage Bills & Expenses

SMS Reminders

Auto Sync & Backup

Ready & Return Filing

60+ detailed reports

Product Details

Customized Rates

We Provide Useful Services

Big Data Consulting

Many variation established fact reader will be distracted by the of readable content .

Machine Learning

Contrary to established fact that a reader will be distracted by the of readable content .

Computer Vision

Variations established fact that a reader will be distracted the of readable content .

Data Analytics

Established fact that a reader will be distracted by passages the of readable content .

Internet Of Things

It is a long established fact that a reader will be distracted by the of readable content .

Artificial Intelligence

Contrary to established fact that a reader will be distracted by the of readable content .

How Does Xamin Works

User Behavior

There are established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Apply Algorithm

Contrary to popular fact that a reader will be distracted by the readable when looking at its layout content of a page.

Apply Algoritham

Many variations established fact reader will be distracted by the readable content of a page when at its layout looking.

Simple and Transparent Pricing

29$

Starter

Feedback System

- Live Chat and email

- Mobile SDK

- 6000 + Intigrations

- Email, Chat and Social

- Basic Help Center

49$

Growth

Feedback System

- Mobile SDK

- Live Chat and email

- 6000 + Intigrations

- Basic Help Center

- Email, Chat and Social

99$

Enterprise

Feedback System

- Live Chat and email

- Mobile SDK

- Email, Chat and Social

- Basic Help Center

- 6000 + Intigrations

Client Testimonials

Shaheeda Davids

Head of Personal lines at Unison"We reviewed our marketing strategy at the end of 2018 and made a decision to move to a digital platform for our insurance products. Unison chose to partner with Click2Sure based on the following capabilities: Have an existing API for the Unison website to connect directly into, Policy enrolment process, End-to end administration platform, Policyholder self-service portal, Back-end reporting, Full claims processing, Facilitation of cross selling and policy upgrades."

Geoff Ferrier

Head of Insurance for Getsure"By using the Click2Sure insurance platform, GetSure will provide products to customers via an entirely digital platform which enables customers to sign up, add or change policy details, and claim, from one centralised platform, providing the customer with full control of their insurance portfolio. Not only will this integration greatly improve the experience customers have with the GetSure brand, it will also streamline the business with a turnkey solution from sales to reporting.”

Recent Blog

On the back of the global pandemic e-commerce has grown exponentially, in turn driving the demand for courier services. By offering customers comprehensive insurance cover for their goods in transit, courier companies can gain preference over competitors - and load a new revenue stream to their business.

10 million thank yous to our loyal companions: An open letter to the South African pet care industry

Research has shown that petting and playing with animals reduces stress, in as little as a few minutes. Globally, the last two years have surely been the most stressful time in modern history. As we faced one isolating lockdown after another, where did many of us turn for comfort? To animals. Pet adoptions soared globally and in South Africa. Pets give us comfort. Pets give us hope. Pets give us unconditional love. Do we give enough in return?

“The Great Resignation” is here as workers adjust to a post-pandemic world, many seeking a fresh start after two life-changing years. In August 2021, a record 4.3 million Americans resigned their jobs. Implementing insurance cover and other employee benefits can help companies keep good people on board. We specialise in providing the digital insurance solution to employee benefit providers, employee-centric companies and traditional group insurers.

Neobanks, also called challenger banks or digital banks, are fintech companies that are branchless and paperless, instead using digital channels including apps to service their customers’ banking needs. They draw on the latest software and artificial intelligence to engineer tailor made services, while minimising operating costs.

t’s a tough time for South African consumers. The economy remains weak after several bouts of Covid-19, unemployment is at an all-time high and the costs of food and fuel are soaring. As a result, many consumers get into sudden financial difficulties, and find themselves having no choice but to turn to unsecured loan providers for help.

In 2020, global debt exceeded US$ 220 trillion, as the largest one-year surge in world debt since World War II was marked. The main reason? Covid-19. Lockdowns, disruption and loss of income have flowered during the pandemic. In 2022, many consumers are still tackling debt, often turning to loan or debt consolidation providers.

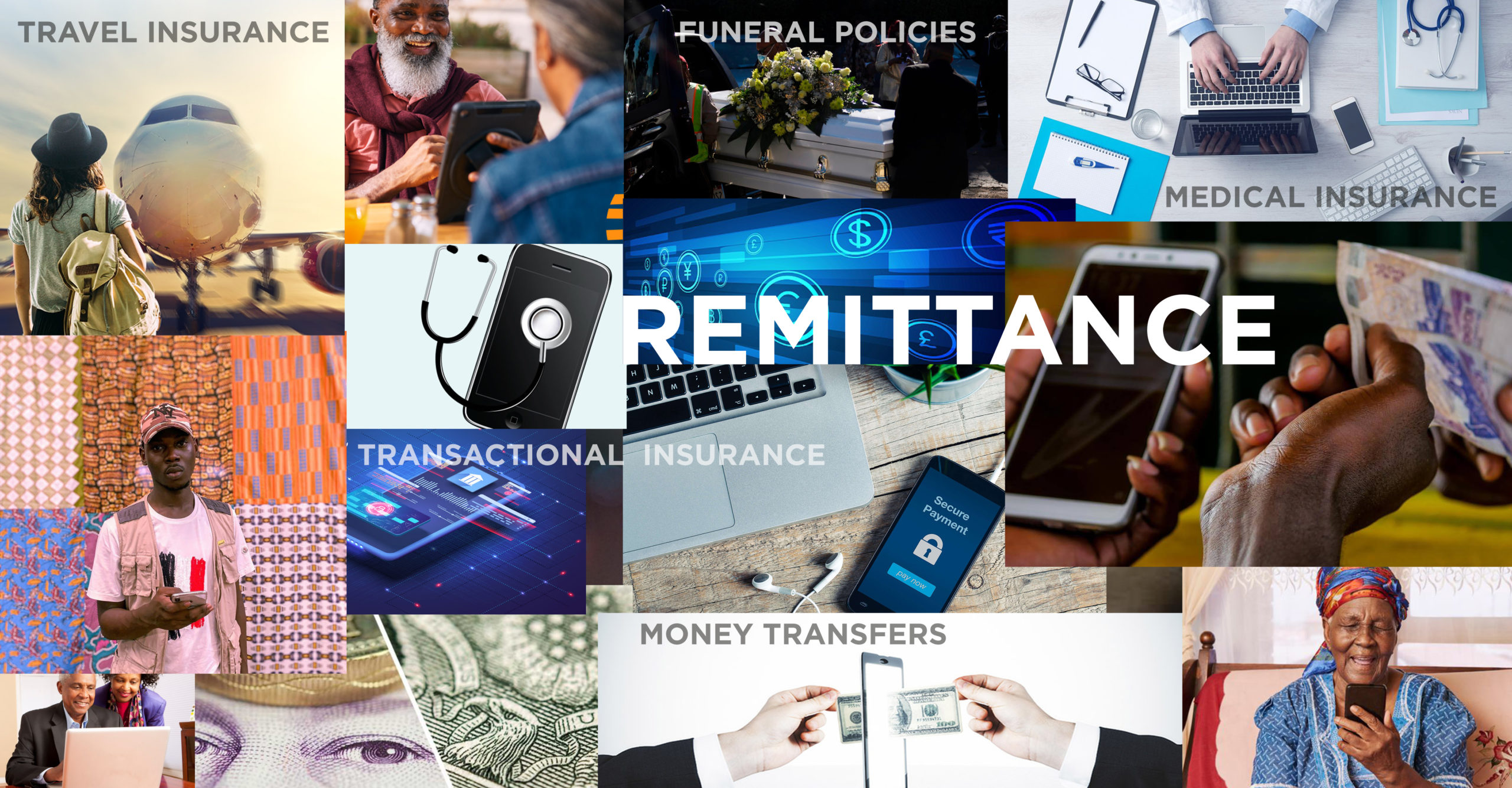

Verified Market Research recently published a report, “Digital Remittance Market”, which revealed that the global remittance/money transfer market was valued at USD 15,9 Million in 2020 and could reach USD 40 Million by 2028. In southern Africa, where migrant work is common and many families have members abroad, the market is especially thriving.

Embedded insurance transforms the paper-based insurance value chain into digital form, enabling non-insurer third parties to integrate insurance products into their platforms.

Insurtechs specialise in bringing together consumer demand and insurance cover wherever gaps in the market exist. One such gap is right in front of your eyes, if you click over to any property website temporarily. Is there a property-related insurance offering on it? If not, there’s the gap.

The extended warranty industry. Think about it much? You should, because it’s growing fast - the global extended warranty market was valued at about $120 billion in 2019 and is projected to reach almost $170 billion by 2027.